Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

Preliminary Proxy Statement | ||

o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

Definitive Proxy Statement | ||

o | Definitive Additional Materials | |

o | Soliciting Material under Rule 14a-12 | |

| KVH INDUSTRIES, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

KVH Industries, Inc.

50 Enterprise Center

Middletown, RI 02842

April 29, 2020[ · ], 2021

Dear Fellow Stockholder:

We are pleased to invite you to attend the KVH 2020Industries, Inc.'s ("KVH") 2021 Annual Meeting of Stockholders. This year's annual meeting will be our first time hosting a completely virtual meeting of stockholders,Stockholders (the "Annual Meeting"), which will be conducted solely online via live webcast. You will be able to attend and participate in the annual meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visitingtake place on [ www.meetingcenter.io/219533378· on], 2021 at [ · ] local time at our world headquarters at 50 Enterprise Center, Middletown, Rhode Island 02842. As part of our COVID-19 precautions, the meeting date atAnnual Meeting may be held solely by means of remote communication rather than in person. We are monitoring the time describedpublic health, travel, business, and social gathering concerns of our stockholders and employees in light of the accompanying proxy statement. There is no physical location for the annual meeting.

Our strategy focuses on delivering superior products and services to large and growing markets. KVH leverages its competitive advantages with business innovation, technology advances, and strong intellectual property as we integrate hardware, software, and services in seamless ways that drive customer success. We deliver high performance mobile connectivity and inertial navigation products and services for maritime operations, IoT connectivity, crew welfare, satellite TV for leisure and land customers,ongoing COVID-19 pandemic, as well as autonomous everythingany related restrictions and manned applications focusedprotocols by federal, state, and local governments. If we determine to hold the Annual Meeting by means of remote communication, we will announce the decision to do so in advance and provide details on accuracy for commercialhow to participate in a press release issued by KVH and military customers. KVH is focusedposting on key strategic initiatives to drive scale and accelerate KVH's profitable growth.our website at www.kvh.com. We are confident that we have in place a highly capable management team and group of directors who are well qualified to oversee the success of the business and to represent all stockholders. We believe our current strategy will create significant long-term value for KVH stockholders.

We remain committed to maintaining an independent and strategically focused Boardalso file definitive additional solicitation materials with the appropriate balance of perspectives, experiences,Securities and tenures, which we believe are key to representing the interests of our stockholders effectively during this time of economic uncertainty. In April, we were thrilled to welcome Robert E. Tavares to the Board, an independent director who brings decades of valuable expertise in the high-tech industry. We are also equally excited to introduce another new independent director nominee for this year, Rear Admiral (Ret) Danelle M. Barrett, who has more than 30 years of experience in global telecommunications operations, cybersecurity strategy, policy, and information technology architectures.Exchange Commission.

OneTwo of our directors, Bruce J. Ryan, isMark S. Ain and Stanley K. Honey, are expected to conclude histheir service on the Board at the annual meeting, when his term expires.Annual Meeting. We thank Mr. RyanMark and Stan for histheir many years of valuable service and are grateful for histheir innumerable contributions to KVH.

In additionYour vote will be especially important this year. As you may be aware, VIEX Capital Advisors, LLC and certain of its affiliates (collectively, "VIEX") have notified KVH that VIEX intends to thisnominate a slate of two nominees for election as directors at the Annual Meeting in opposition to the director nominees recommended by our Board of Directors. As a result, you may receive solicitation materials, including a white proxy card, from VIEX seeking your proxy to vote for VIEX's nominees. Our Board does NOT endorse VIEX's nominees and recommends that you vote FOR each of the nominees proposed by the Board.

As further described in the accompanying proxy statement, webecause VIEX's nominees have failed to provide certain eligibility information as required by the Company's by-laws, our Board has determined that VIEX's nominees are not eligible to stand for election at the Annual Meeting. Accordingly, at the direction of our Board, the person presiding at the Annual Meeting intends to disregard any attempted nomination of VIEX's nominees, and any votes with respect to VIEX's nominees will not be counted at the Annual Meeting.

We encourage you to read our 2019 Annual Report for a more complete picture of our performancethe accompanying proxy statement carefully and how we are working to increase stockholder value.

Finally, we encourage you to vote – regardless of the size of your share holdings.holdings – in accordance with the Board's recommendations on each proposal. Every vote is important, and your participation helps us do a better job of listening and acting on what matters to you as a stockholder. Please vote by completing, signing, and dating the enclosedBLUE voting instruction form or BLUE proxy card and returning it in the enclosed, postage-paid envelope furnished for that purpose. You can also vote over the Internet or by telephone by following the instructions provided on the enclosed BLUE voting instruction form or BLUEproxy card.

If you have any questions or need assistance with voting your BLUE voting instruction form or BLUE proxy card, please contact the firm assisting our Board in the solicitation of proxies:

D.F. King & Co., Inc.

48 Wall St FL 23, New York, NY, 10005-2922

Banks and brokers may call collect at (212) 269-5550

All others may call toll-free at (800) 488-8095

Email: KVH@dfking.com

On behalf of all of us at KVH, we want to thank you for your continued support and ownership of KVH. I hope you will be able to join us at the annual meeting.Annual Meeting.

| Sincerely, | ||||

| ||||

Martin A. Kits van Heyningen President, Chief Executive Officer and Chairman of the Board of Directors |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

| Date and Time: | ||

Venue: | ||

Items of Business: | Proposal 1: To | |

Proposal 2: To approve, on an advisory (non-binding) basis, the | ||

Proposal 3: | ||

Record Date: | Our Board of Directors has fixed the close of business on | |

Voting: | Your vote is very important. Regardless of whether you plan to attend the annual meeting, we hope that you will read the accompanying proxy statement and vote as soon as |

Please note that VIEX Capital Advisors, LLC and certain of its affiliates (collectively, "VIEX") have stated their intention to propose two director nominees for election at the annual meeting. You may receive solicitation materials from VIEX. The Company is not responsible for the accuracy of any information provided by VIEX or its nominees contained in solicitation materials filed or disseminated by or on behalf of VIEX or any other statements that VIEX may make.

The Board does NOT endorse VIEX's nominees and strongly recommends that you NOT sign or return any white proxy card sent to you by VIEX. If you have previously voted using a white proxy card sent to you by VIEX, you can subsequently revoke that proxy by following the instructions on the enclosed BLUE proxy card to vote over the Internet or by telephone or by completing, signing, and dating the BLUE proxy card and mailing it in the postage-paid envelope provided. Only your latest

dated proxy will count. Any proxy may be revoked at any time prior to its exercise at the annual meeting, as described in the accompanying proxy statement.

THE BOARD RECOMMENDS VOTING

FOR EACH OF THE BOARD'S NOMINEES ON PROPOSAL 1 AND

FOR PROPOSALS 2 AND 3 USING THE ENCLOSED BLUE PROXY CARD.

THE BOARD URGES YOU NOT TO SIGN, RETURN, OR VOTE ANY

WHITE PROXY CARD SENT TO YOU BY VIEX.

As further described in the accompanying proxy statement, because VIEX's nominees have failed to provide certain eligibility information as required by the Company's by-laws, our Board has determined that VIEX's nominees are not eligible to stand for election at the annual meeting. Accordingly, at the direction of our Board, the person presiding at the annual meeting intends to disregard any attempted nomination of VIEX's nominees, and any votes with respect to VIEX's nominees on the white voting instruction form or white proxy card will not be counted at the annual meeting.

Please note that, even if you plan to participate in the annual meeting, we recommend that you vote using the enclosed BLUE voting instruction form or BLUE proxy card prior to the annual meeting to ensure that your shares will be represented.

Regardless of the number of shares that you own, your vote is important. Thank you for your continued support, interest, and investment in KVH Industries.

| By Order of the Board of Directors, | ||||

| ||||

| Felise Feingold Secretary | ||||

[ |

TableTO ASSURE THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING, WE URGE YOU TO COMPLETE, SIGN, AND DATE THE ENCLOSED BLUE VOTING INSTRUCTION FORM OR BLUE PROXY CARD AND MAIL IT PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED, OR VOTE BY TELEPHONE OR THE INTERNET AS INSTRUCTED ON THE BLUE VOTING INSTRUCTION FORM OR BLUE PROXY CARD, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. YOU CAN REVOKE YOUR PROXY AT ANY TIME BEFORE THE PROXIES YOU APPOINTED CAST YOUR VOTES.

If you need assistance, please contact D.F. King & Co., Inc., the firm assisting us in the solicitation of Contentsproxies in connection with the annual meeting. Stockholders may call toll free at (800) 488-8095 or email at KVH@dfking.com. Brokers and banks may call collect at (212) 269-5550.

The Notice of Annual Meeting of Stockholders and the accompanying proxy statement are first being made available to stockholders of record as of [ · ], 2021 on or about [ · ], 2021.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Company's Proxy Statement, Annual Report, and Stockholder Letter are available at www.viewourmaterial.com/KVHI.

YOUR VOTE IS IMPORTANT

| Telephone | Internet | ||||||

| Please complete, sign, date, and return the enclosedBLUE voting instruction form or BLUE proxy card, whether or not you plan to attend the annual meeting. | Use the toll-free telephone number on your BLUE voting instruction form or BLUEproxy card to vote by telephone. | Visit the website noted on yourBLUE voting instruction form or BLUE proxy card to vote via the Internet. |

Important Notice Regarding the Availability of Proxy Materialsfor the Annual Meeting of Stockholders to be Held on June 10, 2020

This proxy statement and our 2019 annual report to stockholders are available on the Internet atwww.kvh.com/annual.You can read, print, download and search these materials at that website.The website does not use "cookies" or other tracking devices to identify visitors.

None of the information on our website or elsewhere on the Internet forms a part of this proxy statement or isincorporated by reference into this proxy statement.

PROXY STATEMENT

for

2021 ANNUAL MEETING OF STOCKHOLDERS OF KVH INDUSTRIES, INC.

[ · ], 2021

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON [ · ], 2021: THIS PROXY STATEMENT AND THE ACCOMPANYING FORM OF PROXY CARD ARE FIRST BEING SENT OR GIVEN TO THE COMPANY'S SECURITY HOLDERS ON [ · ], 2021.

TABLE OF CONTENTS |

This proxy statement (including all appendices attached hereto, this "proxy statement") is furnished in connection with the solicitation of proxies by the Board of Directors ("Board" or "Board of Directors") of KVH Industries, Inc., a Delaware corporation (the "Company" or "KVH"), for use at the 2021 annual meeting of stockholders of the Company (including any adjournments, postponements, or continuations thereof, the "annual meeting"). Unless the context otherwise requires, references in this proxy statement to "KVH," the "Company," "we," "us," "our," and similar terms refer to KVH Industries, Inc.

2021 PROXY STATEMENT SUMMARY |

The proxyThis summary is an overview of information that you will find elsewhere in this proxy statement and our 20192020 annual report. As this section is only a summary and does not contain all of the information that you should consider, we encourage you to read the entire proxy statement and annual report for more information about these topics before you vote.

Information About the Annual Meeting

Our Board is soliciting proxies for the annual meeting.

Date and Time | [ | |

Venue

| Offices of KVH Industries, Inc., 50 Enterprise Center, Middletown, Rhode Island 02842. As part of our COVID-19 precautions, the annual meeting

| |

Record Date: | The close of business on [·], 2021. | |

Voting: | Each share of common stock outstanding on the |

PROPOSALS AND BOARD RECOMMENDATIONS FOR VOTING MATTERS

Management Proposals | | Board | | Page | ||||||

1. Election of Directors | FOR each of the Board's | |||||||||

2. | | FOR | | |||||||

3. | ||||||||||

| FOR | |||||||||

| | | | | | | | |

Your vote is extremely important this year. ELECTION OF DIRECTORS

You may receive solicitation materials from VIEX Capital Advisors, LLC and certain of its affiliates (collectively, "VIEX") seeking your proxy to vote for John Mutch and Eric Singer to become members of the Board. The Company is not responsible for the accuracy of any information provided by VIEX or its nominees contained in solicitation materials filed or disseminated by or on behalf of VIEX or any other statements that VIEX may make.

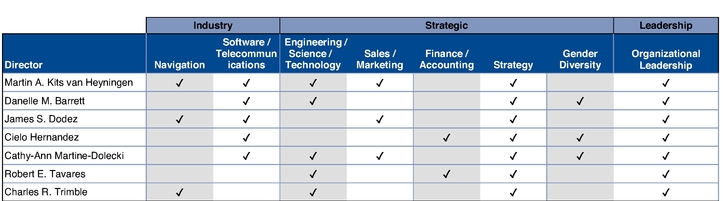

The following table provides summary information about our nominees for election to the Board as Class III Directors. Additional information for all Directors, including the nominees, may be found on pages 8-9 and 24-26.

| Name | Age | Director Since | Independent | Committee Membership | ||||

| Danelle M. Barrett | 52 | — | Yes | None | ||||

| James S. Dodez | 61 | 2017 | Yes | None | ||||

| | | | | | | | | |

APPROVALOUR BOARD DOES NOT ENDORSE ANY OF THE AMENDMENTVIEX NOMINEES AND RESTATEMENTURGES YOU NOT TO SIGN OR RETURN ANY WHITE PROXY CARD SENT TO YOU BY VIEX. IF YOU HAVE PREVIOUSLY SIGNED A WHITE PROXY CARD SENT TO YOU BY VIEX, YOU CAN REVOKE IT BY COMPLETING, SIGNING, DATING, AND RETURNING THE ENCLOSED BLUE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED. ONLY YOUR LATEST DATED PROXY WILL BE COUNTED.

AS FURTHER DESCRIBED IN THE "BACKGROUND OF OUR 2016 EQUITYTHE SOLICITATION" SECTION OF THIS PROXY STATEMENT, BECAUSE THE VIEX NOMINEES HAVE FAILED TO PROVIDE CERTAIN ELIGIBILITY INFORMATION AS REQUIRED BY THE COMPANY'S AMENDED AND INCENTIVE PLAN

RESTATED BY-LAWS (THE "BY-LAWS"), THE BOARD HAS

We are asking our stockholders to approve the KVH Industries, Inc. Amended and Restated 2016 Equity and Incentive Plan, or the 2016 Plan, which increases the number of shares available for issuance under the plan. The 2016 Plan provides for the issuance of both cash awards and equity-based awards, denominated in shares of our common stock, including incentive stock options, non-qualified stock options, stock appreciation rights, restricted stock awards, restricted stock units, unrestricted stock awards, performance share awards and dividend equivalent rights. As amended, the 2016 Plan, if approved by stockholders, will provide for the issuance of up to an aggregate of 4,800,000 shares of common stock, an increase of 1,800,000 shares from 3,000,000 shares, the number approved by our stockholders at the 2016 annual meeting. The foregoing amounts do not include any "roll-over" shares, as described in more detail in "Proposal 2 – Approval of KVH Industries, Inc. Amended and Restated 2016 Equity and Incentive Plan."

Our Board recommends that stockholders approve the 2016 Plan so that we may continue to provide equity and incentive compensation intended to attract, retain and motivate current and prospective officers, employees, directors and consultants. Our Board believes that stock options and other forms of equity and incentive compensation will promote our growth and provide a meaningful incentive to our officers, employees, directors and consultants to perform well.

Stockholder approval of the 2016 Plan is also necessary in order for us to be able to grant stock options that will qualify as "incentive stock options" under the Internal Revenue Code of 1986, as amended, or the Code.

Additional information regarding the 2016 Plan may be found on pages 10 to 19.

KVH Industries, Inc. 20202021 Proxy Statement 1

PROXY SUMMARY

DETERMINED THAT THE VIEX NOMINEES ARE NOT ELIGIBLE TO STAND FOR ELECTION AT THE ANNUAL MEETING. ACCORDINGLY, AT THE DIRECTION OF THE BOARD, THE PERSON PRESIDING AT THE ANNUAL MEETING INTENDS TO DISREGARD ANY ATTEMPTED NOMINATION OF THE VIEX NOMINEES, AND ANY VOTES WITH RESPECT TO THE VIEX NOMINEES ON THE WHITE VOTING INSTRUCTION FORM OR WHITE PROXY CARD WILL NOT BE COUNTED AT THE ANNUAL MEETING.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH OF OUR BOARD'S NOMINEES LISTED ON THE ENCLOSED BLUE VOTING INSTRUCTION FORM OR BLUE PROXY CARD.

For more information and up-to-date postings, please go to our website, www.kvh.com. Information on our website is not, and will not be deemed to be, a part of this proxy statement or incorporated into any of our other filings with the SEC. If you have any questions, please contact D.F. King & Co., Inc., the firm assisting us in the solicitation of proxies in connection with the annual meeting. Stockholders may call toll free at (800) 488-8095 or email at KVH@dfking.com. Brokers and banks may call collect at (212) 269-5550.

NOTE: Submitting a white proxy card will revoke any vote you previously made via the Board's BLUE proxy card. Accordingly, if you wish to vote pursuant to the recommendation of the Board, you should complete, sign, date and return a BLUE voting instruction form or BLUE proxy card and DISREGARD any white voting instruction form or white proxy card that you may receive from VIEX.

Table provides summary information about our nominees for election to the Board as Class I directors. Additional information for all directors, including the Board's nominees, may be found on pages 19 and 24.

| Name | Age | Director Since | Independent | |||

| Cielo Hernandez | 45 | — | Yes | |||

| Cathy-Ann Martine-Dolecki | 62 | — | Yes | |||

| | | | | | | |

KVH is a leading provider of innovative, technology-driven connectivity, and navigation solutions to maritime, marine, defense, and other commercial customers globally. Through our mobile connectivity business, we provide global high-speed Internet, television, and voice services via satellite to mobile users at sea and on land. We are also a leading provider of commercially licensed entertainment, including news, sports, music, and movies, to commercial and leisure customers in the maritime, hotel, and retail markets.

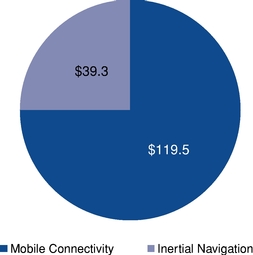

| 2020 Revenue | 2020 Net Loss from Continuing Operations (GAAP) | 2020 Adjusted EBITDA from Continuing Operations (Non-GAAP) | Year-End Market Cap | Employees | ||||

|---|---|---|---|---|---|---|---|---|

$158.7 million | $(21.9 million) | $3.1 million | $209.2 million | 639 |

For a reconciliation of our non-GAAP adjusted EBITDA from continuing operations to our net loss from continuing operations, as well as other information about this non-GAAP financial measure, please see the section entitled "Non-GAAP Financial Information."

2 KVH Industries, Inc. 2021 Proxy Statement

PROXY SUMMARY

Since the onset of the pandemic, we have taken quick and decisive action to adapt our business and practices to ensure the health and safety of our employees while delivering on our fundamental commitment to serving our customers. By the time COVID-19 was declared a pandemic, KVH had a comprehensive action plan in place. As a global technology company, we leveraged our existing IT infrastructure to seamlessly transition most of our corporate staff to work-from-home, enabling us to continue delivering 24/7, uninterrupted service to our customers.

As an essential business for both telecommunications services and defense navigation products, we maintained full operations at both of our factories, making important modifications to allow for social distancing and increased cleaning and sanitization. We also provided protective masks, gloves, hand sanitizer, and other tools to protect the health and safety of our employees.

Given the uncertainty of the pandemic's impact on our business, we also took unprecedented measures to align our costs with the current business environment. We temporarily reduced executive salaries and bonuses, as well as certain non-executive salaries, that were restored in September 2020. We also made targeted reductions to sales and marketing costs, primarily due to the significant reduction in travel and spending on trade shows. With the benefit of these cost-reduction measures and the support of a loan under the Paycheck Protection Program, we were able to avoid layoffs and maintain our workforce during a challenging time, allowing us to continue to support our customers and maintain our focus on executing on our strategic initiatives.

Like many other businesses around the world, the global COVID-19 pandemic has impacted many areas of our business. The operations of our KVH Media Group business, which offers commercially licensed news, music, TV, and movie entertainment for the retail, hotel, and other industries, have been particularly affected due to the global reduction in travel resulting from the pandemic and resulted in an impairment charge of $10.5 million, which is included in the 2020 operating loss.

Despite the significant challenges posed by the pandemic, 2020 included many successes and progress on our strategic initiatives. We ended our year positively, reporting overall revenue growth and an increase in adjusted EBITDA in the fourth quarter. We continued to migrate customers to our new high-throughput satellite (HTS) network, and we expect to complete the migration later this year, which we expect to reduce annual network operating costs by approximately $4 million to $5 million starting next year. We continued to show growth in our subscription-based, Connectivity-as-a-Service (CaaS) AgilePlans offering, continued to develop our sales channel partnerships for KVH Watch, our new Internet of Things (IoT) CaaS offering, which we expect to provide a robust pipeline of future revenue opportunities, and continued to commercialize our photonic integrated chip (PIC) inertial navigation technology.

Thanks to the extraordinary efforts and commitment of our employees, we were able to continue to deliver for our customers despite the challenging environment, and our core business remained strong.

KVH Industries, Inc. 2021 Proxy Statement 3

PROXY SUMMARY

COMMITMENT TO GOOD CORPORATE GOVERNANCE

Our Board of Directors monitors best practices in governance and adopts measures it determines to be in the best interest of stockholders. Highlights of our governance practices include:

ü Following the annual meeting, and assuming our Board's nominees are elected, our Board will include three women (43% gender diversity) |

ü Our directors are elected |

ü

|

ü All of the members of our audit, compensation and nominating and corporate governance committees are independent |

ü We have appointed a lead independent director to serve as a liaison between our independent directors and our Chairman of the Board, who is our President and Chief Executive Officer |

ü Executive sessions of independent directors are held at each regularly scheduled Board meeting |

ü We rotated our independent registered public accounting firm in June 2014 |

ü We conduct |

ü The majority of director compensation is in the form of KVH common stock |

ü We have a strong pay-for-performance executive compensation philosophy |

ü We conduct annual non-binding "say on pay" votes regarding our executive compensation program |

ü We do not have any executive employment agreements or change in control agreements |

ü Our independent compensation consultant is hired by the compensation committee |

ü We conduct annual |

ü We prohibit short sales, transactions in derivatives, hedging, and pledging of KVH securities by our directors and named executive officers |

NON-BINDING "SAYADVISORY VOTE ON PAY" VOTENAMED EXECUTIVE OFFICER COMPENSATION

We are asking our stockholders to approve, in a non-binding vote, the compensation awarded to our named executive officers for 2019.2020. The Compensation Committee of our Board of Directors oversees our executive compensation program, which is designed to motivate our executives to increase profitability and stockholder returns, to tie pay to performance effectively, and to compete effectively for and retain managerial talent.

We are asking our stockholders to indicate their support for our named executive officer compensation. We believe that our executive compensation program was designed appropriately and is working to ensure that management's interests are aligned with our stockholders' interests to support long-term value creation.

This "say on pay" vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the compensation methodology described in this proxy statement. While this vote is advisory and not binding, the Board and the Compensation Committee will consider the outcome of the vote, along with other relevant factors, when considering future executive compensation decisions.

Additional information regarding the non-binding "say on pay" vote may be found on pages 20 to 22.page 20.

24 KVH Industries, Inc. 20202021 Proxy Statement

PROXY SUMMARY

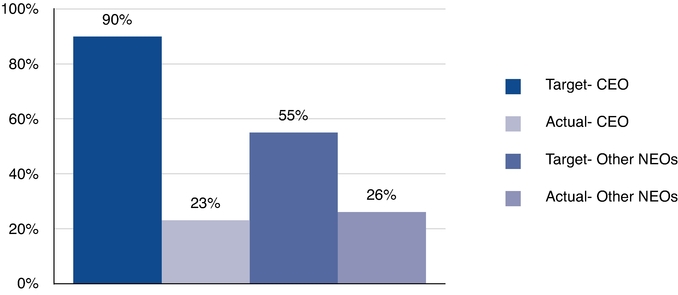

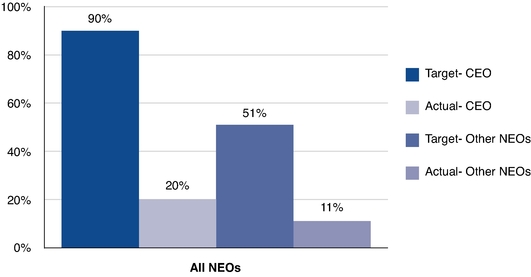

20192020 EXECUTIVE COMPENSATION HIGHLIGHTS

The 20192020 compensation program for our named executive officers was comprised of three primary elements – base salary, cash-based incentive compensation, and annual equity grants. We believe the compensation program for our named executive officers included key features that aligned the interests of our executives with KVH's business strategies and goals and stockholders' interests.

| The mix of target compensation for our named executive officers for 2020 reflects these objectives, as shown in the chart. The percentages shown represent percentages of average total target compensation, not average total actual compensation, and as a result do not match the percentages calculable from actual compensation reflected in the Summary Compensation Table on page 31. For 2020, fixed pay represents the sum of salary, holiday bonus and perquisites; variable ("at-risk") pay represents equity awards and non-equity incentive plan compensation. For more information on the compensation of our named executive officers for 2020, see "Proposal 2 – Advisory Vote on Named Executive Officer Compensation". | Average NEO Compensation Mix

|

| What We Do | What We Don't Do | |

ü Offer competitive compensation that attracts and retains executive talent ü Align the interests of our named executive officers with those of our stockholders and reward the creation of long-term value for KVH stockholders through equity grants ü Emphasize variable performance-based compensation over fixed compensation ü Align payout of annual incentives to drivers of stockholder value, such as revenue and adjusted EBITDA ü Balance the importance of achieving long-term strategic priorities and critical short-term goals linked to long-term objectives ü Align individual performance goals with our business strategy ü Cap incentive payments ü Benchmark compensation against that of a broad group of companies ü Cash and equity awards under our 2016 Equity and Incentive Plan have clawback provisions | ✗ No long-term employment agreements or change of control agreements ✗ No guaranteed severance programs ✗ No tax gross-ups ✗ No guaranteed salary increases ✗ No repricing of stock options or stock appreciation rights ✗ No discounted stock options or stock appreciation rights |

|

KVH Industries, Inc. 20202021 Proxy Statement 35

PROXY SUMMARY

For 2019,2020, we had a non-equity incentive compensation plan intended to reward our named executive officers for achievement of corporate, business unit and individual performance goals for that year. In March 2019, in orderMay 2020, as a result of the potential adverse impact that the COVID-19 pandemic was anticipated to improve morale and promotehave on our business, senior management implemented, with the retentionapproval of certain of our named executive officers, the Compensation Committee, decideda cash conservation and cost reduction plan (the "Cost-Savings Plan") that included, among other cost-saving measures, temporary reductions in executive base salaries and bonus opportunities for the named executive officers. The reductions took effect on May 11, 2020 and continued until September 25, 2020 (the "Cost-Savings Period"), the point at which we determined that the Cost-Savings Plan was no longer warranted. During the Cost-Savings Period, executive base salaries were reduced by 15% for the CEO and 10% for our other named executive officers. In addition to prepay athe temporary reductions in base salary, the portion of theeach named executive officer's target amounts that the executives were eligible to earn under the plan; these prepaid amounts were non-refundable but would be credited in full against any corporate or business unit incentive compensation amounts earnedattributable to individual performance during 2020 (representing 25% of the executive's total target incentive compensation) under our 2020 incentive compensation plan was reduced by 30% during the plan.Cost-Savings Period. In March 2020,2021, after assessingreviewing our overall financial performance for 2019, our2020, the Compensation Committee determined not to awardmake any non-equity incentive compensation to our named executive officers beyond the prepaid amountsawards with respect to ourthe portion of each named executive officer's incentive compensation target attributable to corporate performance or business unit performance goals. Further, our Compensation Committee determined not tobut did award any non-equity incentive compensation to the chief executive officer beyond the prepaid amount. The prepaid amounts represented approximately 23%, 15%, and 13% of base salary for our chief executive officer, chief operating officer, and chief financial officer, respectively. Including both the prepaid amounts and the awards of non-equity incentive compensation for achievement of individual performance that were made undergoals. Taking into account the plan,awards for individual performance, the aggregate incentive compensation actually received by our CEO for 20192020 represented 23%20% of his base salary, rather than the targeted 90% of his base salary, and the aggregate incentive compensation actually received by our other named executivesexecutive officers ranged from approximately 25%9% to 26%13% of their respective base salaries, rather than the targeted range of 50%40% to 60% of their respective base salaries.

Actual Annual Incentive Payment Versus Target*Target

(Average Percentage of Base Salary)

46 KVH Industries, Inc. 20202021 Proxy Statement

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING OF STOCKHOLDERS AND VOTING |

Why am I receiving these proxy materials? |

Our Board is soliciting your vote at the annual meeting, which is to be held on [ · ], 2021 at [ · ], Eastern Time. The annual meeting will be held at the offices of KVH, located at 50 Enterprise Center, Middletown, Rhode Island. As part of our COVID-19 precautions, the annual meeting may be held solely by means of remote communication rather than in person. We are monitoring the public health, travel, business, and social gathering concerns of our stockholders and employees in light of the ongoing COVID-19 pandemic, as well as any related restrictions and protocols by federal, state, and local governments. If we determine to hold the annual meeting by means of remote communication, we will announce the decision to do so in advance and provide details on how to participate in a press release issued by KVH and posting on our website at www.kvh.com. We will also file definitive additional solicitation materials with the Securities and Exchange Commission.

These materials also include a BLUE voting instruction form or BLUE proxy card for the annual meeting. BLUE voting instruction forms and BLUE proxy cards are being solicited on behalf of the Board. The proxy materials include detailed information about the matters that will be discussed and voted on at the annual meeting and provide updated information about the Company that you should consider in order to make an informed decision when voting your shares.

What is the purpose of the annual |

At the annual meeting, we will submit the following proposals to our stockholders:

| Proposal 1 | To elect two nominees as Class | |

Our Board's Voting Recommendation | FOR EACH NOMINEE RECOMMENDED BY OUR BOARD | |

Proposal 2 | To approve, | |

FOR |

| Proposal 3 | To ratify the appointment of Grant Thornton LLP as our independent registered public accounting | |

Our Board's Voting Recommendation | FOR |

Our Board of Directors does not intend to present to the annual meeting any business other than the proposals described in this proxy statement. Our Board of Directors was not aware, a reasonable time before mailing this proxy statement to stockholders, of any other business that mayto be properly presented for action at the annual meeting. IfHowever, if any other business shouldmatters properly come before the annual meeting, the persons presentindividuals named as proxies, or their duly constituted substitutes acting at the annual meeting, will have discretionary authoritybe authorized to vote the shares they own or represent by proxyotherwise act thereon in accordance with their judgment to the extent authorized by applicable regulations.on such matters.

How many votes do I have? |

You will have one vote for every share of common stock you owned as of the close of business on the record date.

When is the record date? |

Our Board of Directors has fixed the close of business on Monday, April 20, 2020,[ · ], 2021, as the record date for the annual meeting. Only stockholders of record as of the close of business on that date are entitled to receive notice of, the annual meeting, and to vote at, the annual meeting. At the close of business on the record date, there were 17,993,244[ · ] shares of our common stock outstanding. Each share of common stock outstanding on the record date will be entitled to cast one vote.

How many votes can be cast by all stockholders? |

[ · ] votes, consisting of one vote for each share of common stock outstanding on the record date. There is no cumulative voting, and the holders of the common stock vote together as a single class.

Why have I received different color proxy cards? |

VIEX has notified the Company that VIEX intends to propose two director nominees for election at the annual meeting in opposition to the director nominees recommended by our Board. The Company has provided you with the enclosed BLUE voting instruction form or BLUE proxy card. VIEX may send you a white voting instruction form or white proxy card.

KVH Industries, Inc. 2021 Proxy Statement 7

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING OF STOCKHOLDERS AND VOTING

The Board recommends using the enclosed BLUE voting instruction form or BLUE proxy card to vote FOR each of the Board's nominees for director. Our Board also recommends that you DISREGARD the white voting instruction form and white proxy card.

As further described in the "Background of the Solicitation" section of this proxy statement, because the VIEX Nominees have failed to provide certain eligibility information as required by the By-laws, the Board has determined that the VIEX Nominees are not eligible to stand for election at the annual meeting. Accordingly, at the direction of the Board, the person presiding at the annual meeting intends to disregard any attempted nomination of the VIEX Nominees, and any votes with respect to the VIEX Nominees on the white voting instruction form or white proxy card will not be counted at the annual meeting.

What are the methods of voting? |

The shares represented by your properly signedBLUE proxy card will be voted in accordance with your directions. If you do not specify a choice with respect to a proposal for which our Board of Directors has made a recommendation, the shares covered by your signed BLUEproxy card will be voted as recommended by our Board in this proxy statement. We encourage you to vote on all matters to be considered. Our Board urges you NOT to sign or return any white proxy card that may be sent to you by VIEX. If, on the record date,

your shares were not held in your name, but rather were held in an account at a broker, dealer, bank or other nominee (commonly referred to as being held in "street name"), you are the beneficial but not record owner of those shares. A beneficial owner should follow the instructions of his, her or its broker, dealer, bank or other nominee in order to vote any shares.

![]()

By signing and returning the BLUEproxy card in the enclosed postage pre-paid envelope, you are enabling each individual named on the BLUEproxy card (known as a "proxy") to vote your shares at the annual meeting in the manner you indicate. We encourage you to sign and return theBLUE proxy card, even if you plan to attend the annual meeting. In this way, your shares will be voted even if you are unable to attend the meeting. If you received more than one BLUEproxy card, it is an indication that your shares are held in multiple accounts. Please sign and return all BLUEproxy cards to ensure that all of your shares are voted. Our Board urges you NOT to sign or return any white proxy card that may be sent to you by VIEX.

![]()

To vote by telephone, please follow the instructions included on yourBLUE proxy card. If you vote by telephone, you do not need to complete and mail your BLUEproxy card.

![]()

To vote on the Internet, please follow the instructions included on yourBLUE proxy card. If you vote on the Internet, you do not need to complete and mail your BLUEproxy card.

![]()

To vote your shares online at the meeting, please follow the registration instructions as outlined in this proxy statement.

Will my shares be voted if I do nothing? |

If your shares of our common stock are registered in your name, you must complete, sign, date, and return a proxy card or submit a proxy by telephone or by Internet in order for your shares to be voted.

If your shares of common stock are held in "street name," that is, held for your account by a broker, bank or other nominee, and you do not instruct your broker, bank or other nominee how to vote your shares, then, to the extent your broker, bank or other nominee has forwarded VIEX's proxy materials to you, your broker, bank or other nominee would not have discretionary authority to vote your shares on the proposals to be considered at the annual meeting. If your shares of our common stock are held in "street name," your broker, bank or nominee has enclosed a BLUE voting instruction form with this proxy statement. We encourage you to authorize your broker, bank or other nominee to vote your shares by following the instructions provided on the BLUE voting instruction form.

We strongly urge you to vote FOR each of our Board's nominees listed in Proposal 1, and FOR Proposals 2 and 3 by using the enclosed BLUE proxy card to vote TODAY by Internet, by telephone or by signing, dating and returning the enclosed BLUE proxy card in the envelope provided. If your shares are held in "street name," you should follow the instructions on the BLUE voting instruction form provided by your broker, bank or other nominee and provide specific instructions to your broker, bank or other nominee to vote as described above.

What constitutes a quorum? |

A quorum must be present in order for business to be conducted at the annual meeting. Our by-lawsBy-laws provide that a quorum consists of a majority of the shares of common stock issued and outstanding and entitled to vote at the annual meeting.meeting present in person or represented by proxy. Shares of common stock represented by a properly signedcompleted and returned proxy card (including shares properly voted by telephone or on the Internet) will be treated as present at the annual meeting for purposes of determining the existence of a quorum at the annual meeting. Abstentions and broker "non-votes"non-votes (if any) are

8 KVH Industries, Inc. 2021 Proxy Statement

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING OF STOCKHOLDERS AND VOTING

counted as present or represented for purposes of determining the existence of a quorum at the annual meeting.

What is a broker non-vote? |

A "non-vote"broker non-vote occurs when a broker or nominee holding shares for a beneficial owner returns a proxy card but does not vote that owner's shares on a proposal because the broker or nominee does not have discretionary voting powerdiscretion to vote on a particular proposal and the broker has not received instructions from that owner.the beneficial owner of the shares of common stock as to how to vote on such proposal. As a result, if you do not instruct your broker on how to vote your shares regarding the election of directors, the advisory approval of the compensation of our named executive officers, and the ratification of Grant Thornton LLP as our independent registered public accounting firm for 2021, then your shares may not be voted on these matters. We urge you to instruct your broker about how you wish your shares to be voted.

Who can attend the annual meeting? |

Attendance at the annual meeting will be limited to stockholders as of [ · ], 2021, their authorized representatives and guests of the Company. Access to the annual meeting may be granted to others at the discretion of the Company. In accordance with the Company's security procedures, all persons attending the annual meeting must

present picture identification along with proof of ownership. If you are a stockholder of record, please be prepared to provide the top portion of your BLUE proxy card. If you hold your shares in "street name," you will need to provide proof of ownership, such as a recent account statement or letter from your bank, broker, or other nominee. Cameras and recording devices will not be permitted at the annual meeting.

Even if you plan to attend the annual meeting, we strongly urge you to vote in advance by completing, signing, and dating the enclosed BLUE voting instruction form or BLUE proxy card and returning it in the postage-paid envelope provided or by voting via the Internet or by telephone.

Is a list of registered stockholders available? |

The Company's list of stockholders as of the close of business on the record date will be available for inspection by the Company's stockholders for at least ten days prior to the annual meeting. If you want to inspect the stockholder list, please call the office of the Secretary at (401) 845-8102 to schedule an appointment during ordinary business hours. The stockholder list will also be open to the examination of any stockholder during the annual meeting at the place of the meeting.

What vote is required for approval? What is the effect of absentions and broker non-votes on each of the proposals? |

| Proposal | Vote Required for Approval | Effect of Abstentions and Broker Non-Votes | ||

| Proposal 1 – To elect two nominees as Class I directors for a three-year term expiring in 2024 | The affirmative vote of a majority of the votes cast. | Abstentions will have no effect on the outcome of the election of directors. Broker discretionary voting is not permitted, and broker non-votes will have no effect on the outcome of this proposal. | ||

| Proposal 2 – To approve, on an advisory (non-binding) basis, the compensation of our named executive officers | The affirmative vote of a majority of the votes cast. | Abstentions will have no effect on the outcome of the proposal. Broker discretionary voting is not permitted, and broker non-votes will have no effect on the outcome of this proposal. | ||

| Proposal 3 – To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2021 | The affirmative vote of a majority of the votes cast. | Abstentions will have no effect on the outcome of the proposal. Broker discretionary voting is not permitted if VIEX delivers its proxy materials to your broker, bank or other nominee on your behalf. If VIEX does not provide your broker, bank, or other nominee with solicitation materials, your broker, bank, or other nominee will be able to vote your shares with respect to this proposal. Broker non-votes (if any) will have no effect on the outcome of this proposal. | ||

| | | | | |

KVH Industries, Inc. 20202021 Proxy Statement 59

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING OF STOCKHOLDERS AND VOTING

|

The annual meetingIt will be a completely virtual meeting of stockholders, which will be conducted exclusively online. You are entitled to participate in the annual meeting onlyNOT help elect our Board's nominees if you weresign and return a stockholder of record as of the close of business on April 20, 2020 or if you hold a valid proxy for the annual meeting. No physical meeting will be held. You will be able to attend the annual meeting online and submit your questions during the meeting by visitingwww.meetingcenter.io/219533378. You also will be able to vote your shares online by attending the annual meeting virtually on the Internet.

To participate in the annual meeting, you will need the 16-digit control number included on yourwhite proxy card orsent by VIEX. Doing so will revoke any previous vote you may have cast on the instructions that accompanied yourKVH's BLUE proxy materials. The password for the meeting is KVHI2020. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below. The online meeting will begin promptly at 11:00 a.m., Eastern Time.card. We encourage you to accessvote FOR each of the meeting priorBoard's nominees on our BLUE voting instruction form or BLUE proxy card and to the start time, leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement.

|

If you are a shareholder of record (i.e., you hold your shares through our transfer agent, Computershare), you doDISREGARD, and not need to register to attend the annual meeting virtually on the Internet. Please follow the instructions on thereturn, any white voting instruction form or white proxy card that you received.receive from VIEX.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advancePursuant to attend the annual meeting virtually on the Internet. To register to attend the annual meeting online you must submit proof that you have a legal proxy from your intermediary reflecting your KVH shares, along with your name and email address, to Computershare. Requestsour By-laws, written notice by stockholders of qualifying nominations for registration must be labeled as "Legal Proxy" and be received no later than 5:00 p.m., Eastern Time, on June 9, 2020. Computershare will send a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us via email by forwarding the email from your bank, broker or other intermediary, or attaching an image of your legal proxy, to legalproxy@computershare.com or by regular mail at the following address:

ComputershareKVH Industries, Inc. Legal ProxyP.O. Box 43001Providence, RI 02940-3001

|

We continue to monitor the coronavirus (COVID-19) situation, and we are sensitiveelection to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose or recommend. For this reason, amongst others, we determined to hold this year's annual meeting solely by means of remote communication. As always, we encourage you to vote your shares prior to the meeting.

|

A majority of the votes properly castBoard at the annual meeting willmust have been received by February 4, 2021. We did not receive any such nominations, other than the nominations from VIEX, and no other nominations for election to the Board may be necessary to elect each Class III director to a three- year term (proposal 1), to approvemade by stockholders at the amendment and restatementannual meeting.

However, as further described in the "Background of the 2016 Plan (proposal 2),Solicitation" section of this proxy statement, because the VIEX Nominees have failed to approve, inprovide certain eligibility information as required by the non-binding "say on pay" vote,By-laws, the compensation of our named executed officers (proposal 3), andBoard has determined that the VIEX Nominees are not eligible to approvestand for election at the ratificationannual meeting. Accordingly, at the direction of the appointment of Grant Thornton LLP as our independent registered public accounting firm (proposal 4). A majority ofBoard, the votes properly castperson presiding at the annual meeting intends to disregard any attempted nomination of the VIEX Nominees, and any votes with respect to the VIEX Nominees on the white voting instruction form or white proxy card will not be necessary to approve any other matter that may be properly acted uponcounted at the annual meeting. For more information on majority voting, please see "Board of Directors

The Board has no reason to believe that Cielo Hernandez and CommitteesCathy-Ann Martine-Dolecki will not serve if elected. However, if, for some reason, any of the Board's director nominees are unable to serve, or for good cause will not serve if elected, the persons named as proxies may vote for a substitute nominee recommended by the Board – Corporate Governance—Majority Voting."and, unless you indicate otherwise on the BLUE proxy card, your shares will be voted in favor of the Board's remaining nominees. If any substitute nominee is designated prior to the annual meeting, we will file an amended proxy statement that, as applicable, identifies the substitute nominee, discloses that such nominee has consented to being named in the revised proxy statement and to serve if elected, and includes certain biographical and other information about such nominee required by the rules of the SEC.

|

Abstentions and broker "non-votes" will not be included in calculating the number of votes cast on any proposal. As a result, abstentions and broker "non-votes" will not have any effect on the outcome of the vote on any proposal.

Who will count the votes? |

Our transfer agent, Computershare Trust Company, N.A., will separately tabulateWe have retained Corporate Election Services to assist as the votes on each matter presentedtabulator of the BLUE proxy cards and have retained First Coast Results, Inc. to the stockholdersserve as independent inspector to count and certify votes at the annual meeting.

Who is soliciting my vote? |

We are soliciting proxies on behalf of our Board of Directors. No compensation will be paid by any person for our solicitation of proxies. In addition, we will reimburse brokers, dealers, banks and other nominees for the out- of-pocketout-of-pocket expenses and other reasonable clerical expenses they incur in obtaining instructions from beneficial owners of our common stock. In addition to our solicitation by mail, our directors, officers and employees may make special solicitations of proxies personally or by telephone, facsimile, courier or e-mail.email. We expectwill pay all expenses incurred in connection with this solicitation. We have also retained D.F. King & Co., Inc. to solicit proxies.

Can I change my vote? How can a proxy be revoked? |

Yes. If you are a stockholder of record, you may revoke your proxy at any time before it is voted at the meeting. Only your latest dated proxy will count. In order to revoke your proxy, you must either:

If you hold your shares in street name, you should follow the instructions of your broker, bank or other nominee to change your vote or revoke your voting instructions. Your attendance at the annual meeting will not revoke your proxy unless you specifically request it or you vote at the annual meeting. If you hold shares in street name, your attendance at the annual meeting will not revoke your voting instructions. In the absence of a revocation, shares represented by proxies will be voted at the annual meeting.

If you have previously submitted a white proxy card sent to you by VIEX, you may change your vote by completing, signing, dating, and returning the enclosed BLUE proxy card in the postage-paid envelope provided, or by voting via the Internet or by telephone by following the instructions on the BLUE proxy card. Please note that submitting a white proxy card sent to you by VIEX will revoke votes you have previously made via the expense of any specialCompany's BLUE proxy card.

Whether or not you plan to attend the annual meeting, we urge you to complete, sign, date, and return the enclosed BLUE voting instruction form or BLUE proxy card in the postage-paid envelope provided, or vote via the Internet or by telephone as instructed on the BLUE voting instruction form or BLUE proxy card.

610 KVH Industries, Inc. 20202021 Proxy Statement

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING OF STOCKHOLDERS AND VOTING

solicitationAs further described in the "Background of the Solicitation" section of this proxy statement, because the VIEX Nominees have failed to provide certain eligibility information as required by the By-laws, the Board has determined that the VIEX Nominees are not eligible to stand for election at the annual meeting. Accordingly, at the direction of the Board, the person presiding at the annual meeting intends to disregard any attempted nomination of the VIEX Nominees, and any votes with respect to the VIEX Nominees on the white voting instruction form or white proxy card will not be nominal. We will pay all expenses incurred in connection with this solicitation.counted at the annual meeting.

|

We will bear the cost of the solicitation of proxies on behalf of the Board of Directors. For additional information regarding the cost of this solicitation, please see the section titled "Additional Information—Costs of Solicitation" on page 48 of this proxy statement.

How can I find the voting results of the Annual Meeting? |

Voting results will be tallied by the inspector of election. We will report the preliminary results in a Current Report on

Form 8-K, which we must file with the SEC within four business days following the annual meeting. We will similarly report the final results as soon as practicable following certification by the inspector of election.

Do I have any dissenters' or appraisal rights with respect to any of the matters to be voted on at the annual meeting? |

No. Delaware law does not provide stockholders any dissenters' or appraisal rights with respect to the matters to be voted on at the annual meeting.

Who should I call if I have questions about the annual meeting? |

If you are a stockholder of record, you may revoke your proxy athave any time before it is voted atquestions or require assistance voting on the meeting. In order to revoke your proxy, you must either:

48 Wall St FL 23, New York, NY, 10005-2922

If you hold your shares in street name, you should follow the instructions of your broker, dealer, bank or other nominee to change your vote.brokers may call collect at (212) 269-5550

All others may call toll-free at (800) 488-8095

Email: KVH@dfking.com

KVH Industries, Inc. 20202021 Proxy Statement 711

BACKGROUND OF THE SOLICITATION |

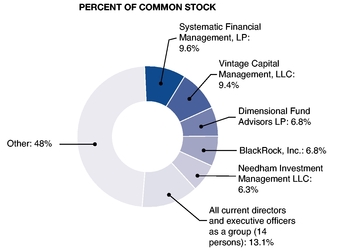

On February 5, 2020, Vintage Capital Management, LLC ("Vintage Capital") filed a Schedule 13D with the SEC disclosing beneficial ownership of approximately 9.39% of the outstanding shares of the Company's common stock.

The next day, on February 6, 2020, Vintage Capital submitted to the Company a notice of Vintage Capital's intent to nominate Robert Tavares and another individual to the Board at the Company's 2020 annual meeting of stockholders (the "2020 Annual Meeting").

On April 8, 2020, Vintage Capital and the Company entered into a cooperation agreement (the "Vintage Capital Cooperation Agreement"). Pursuant to the Vintage Capital Cooperation Agreement, the Company, among other things, agreed to appoint Mr. Tavares to serve as a director of the Company.

At the 2020 Annual Meeting, which was held on June 10, 2020, director Bruce J. Ryan did not stand for re-election and concluded his service as a member of the Board. In addition, Danelle M. Barrett was elected to serve as a director of the Company.

On November 5, 2020, Eric Singer, the managing member of VIEX Capital Advisors, LLC, contacted Brent Bruun, the Company's Chief Operating Officer and then-interim Chief Financial Officer, requesting a call with Mr. Bruun and Martin Kits van Heyningen, the Company's Chief Executive Officer and Chairman of the Board.

On November 6, 2020, Mr. Bruun held a telephone conversation with Mr. Singer. During the conversation, Mr. Bruun discussed with Mr. Singer the Company's business, strategy, operations, and financial performance, and Mr. Bruun addressed certain questions and views conveyed by Mr. Singer. In addition, Mr. Singer represented to Mr. Bruun that VIEX owned more shares of the Company's common stock than Mr. Kits van Heyningen, who held approximately 4.9% of the Company's issued and outstanding shares at the time, as was publicly disclosed. However, according to the preliminary proxy statement filed by VIEX on April 9, 2021 (the "VIEX Preliminary Proxy Statement"), VIEX owned only approximately 2.2% of the Company's issued and outstanding shares as of November 6, 2020, the date Mr. Singer made the representation about his ownership level to Mr. Kits van Heyningen.

On November 16, 2020, Mr. Bruun held a telephone call with Peter T. Shaper to discuss the Company's business and operations.

On November 24, 2020, Messrs. Bruun and Kits van Heyningen held a telephone call with Mr. Shaper to discuss the Company's business and operations.

On January 14, 2021, VIEX Opportunities Fund, LP – Series One ("VIEX Series One"), delivered a notice to the Company indicating its intent to nominate Mr. Singer and John Mutch (the "VIEX Nominees") for election to the Board (the "Nomination Notice"). The Nomination Notice indicated that, as of January 14, 2021, VIEX Series One, together with other entities affiliated with VIEX and Mr. Singer, owned approximately 3.9% of the Company's outstanding shares of common stock.

On January 18, 2021, Mr. Kits van Heyningen held a telephone conversation with Mr. Singer to discuss the Nomination Notice and the Company's business, operations, and strategy. During the discussion, Mr. Singer shared his views on the Company and its performance. Mr. Singer indicated, among other things, that he did not have a specific plan regarding how the Company could improve its performance.

On January 25, 2021, the Board met to discuss the annual meeting, the composition of the Board, the Nomination Notice, and other matters related to VIEX. At the conclusion of the meeting, the Board formed an ad hoc committee comprised of Ms. Barrett and Messrs. Dodez and Kits van Heyningen to manage the response to and discussions with VIEX on behalf of the Board (the "Ad Hoc Committee").

On February 1, 2021, the Ad Hoc Committee met to discuss matters related to VIEX, the composition of the Board, the Nomination Notice, and the Ad Hoc Committee's interest in meeting with the VIEX Nominees to evaluate their candidacies to serve as members of the Board. During the meeting, the Ad Hoc Committee discussed the qualifications and backgrounds of the VIEX Nominees, including the Delaware Court of Chancery's finding in In re PLX Technology Inc. Stockholders Litigation that Mr. Singer breached his fiduciary duties to PLX Technology Inc. ("PLX"), and induced other PLX directors to breach their duties by withholding material information from his fellow directors (the "PLX Case"). At the conclusion of the meeting, the Ad Hoc Committee authorized Mr. Dodez, in his capacity as a member of the Nominating and Corporate Governance Committee of the Board (the "Nominating and Corporate Governance Committee"), to schedule interviews with both of the VIEX Nominees, including, in the case of Mr. Singer, to learn more about the PLX Case.

12 KVH Industries, Inc. 2021 Proxy Statement

BACKGROUND OF THE SOLICITATION

On February 4, 2021, the time period for stockholders to submit director nominations to be considered at the annual meeting pursuant to the By-laws expired.

On February 5, 2021, Mr. Dodez e-mailed both of the VIEX Nominees to schedule interviews regarding their candidacies to serve as members of the Board.

Between February 5, 2021 and February 8, 2021, Mr. Dodez exchanged e-mails with Mr. Singer regarding the VIEX Nominees' willingness to meet with Mr. Dodez and Charles Trimble in their capacities as members of the Nominating and Corporate Governance Committee and the nationally recognized independent executive search firm assisting the Company with its review of potential director candidates (the "Independent Search Firm"). In his communications to Mr. Dodez during this time period, Mr. Singer indicated that he was willing to meet only with all of the independent directors of the Company and only if such meeting was in the context of a potential settlement involving the Company's appointment of the VIEX Nominees as members of the Board.

On February 8, 2021, the Ad Hoc Committee met to discuss the qualifications and backgrounds of the VIEX Nominees, the composition of the Board, and the status of the Board's ongoing refreshment process. During the meeting, the Ad Hoc Committee reviewed background research that had been conducted on the VIEX Nominees and determined that additional information about the backgrounds and experiences of the VIEX Nominees would be necessary to determine their eligibility to serve as directors of the Company.

Later on February 8, 2021, the Company engaged the Independent Search Firm to assist the Company with its review of potential director candidates.

On February 9, 2021, the Board met to discuss, among other things, updates regarding the Company's recent interactions with VIEX.

On February 10, 2021, Mr. Dodez again invited Mr. Singer to interview with members of the Nominating and Corporate Governance Committee in order to permit the Nominating and Corporate Governance Committee to further evaluate Mr. Singer's candidacy for a position as a director of the Company. Mr. Dodez noted that the Nominating and Corporate Governance Committee, on which he and Mr. Trimble served, was responsible for reviewing director candidates and that such committee's charter required the Nominating and Corporate Governance Committee to evaluate candidates nominated by stockholders of the Company.

On February 12, 2021, the Nominating and Corporate Governance Committee met to discuss the composition of the Board, the Company's potential nominees for election to the Board at the annual meeting, and the status of the Board's ongoing refreshment process, including the search being conducted by the Independent Search Firm.

On February 22, 2021, Mr. Singer responded to Mr. Dodez's e-mail of February 10, 2021. Mr. Singer stated that he was willing to meet only with all of the Company's independent directors, subject to the execution of a nondisclosure agreement.

On February 24, 2021, Mr. Dodez e-mailed the VIEX Nominees separately to invite them to meet with members of the Nominating and Corporate Governance Committee. In his e-mail to Mr. Singer, Mr. Dodez noted that the Company did not believe that a nondisclosure agreement would be necessary to Mr. Singer's potential interview, indicating that the Company would neither share non-public information with Mr. Singer nor ask Mr. Singer for non-public information and that Mr. Singer would be under no obligation to answer any question with which he was uncomfortable. Mr. Singer did not respond to Mr. Dodez's e-mail. Mr. Mutch agreed to meet with Messrs. Dodez and Trimble on March 1, 2021.

On February 26, 2021, Mr. Bruun held a telephone call with Mr. Shaper to discuss the Company's business and operations.

On March 1, 2021, Messrs. Dodez and Trimble, in their capacities as members of the Nominating and Corporate Governance Committee, met with Mr. Mutch by videoconference to discuss his candidacy for a position as a member of the Board.

On March 2, 2021, the Ad Hoc Committee met to discuss the meeting that Messrs. Dodez and Trimble held with Mr. Mutch. Mr. Trimble participated in the meeting at the invitation of the Ad Hoc Committee. The Ad Hoc Committee further considered the qualifications, skills, and experience of Mr. Mutch in light of his meeting with Messrs. Dodez and Trimble, and determined that the Independent Search Firm should conduct a further review of Mr. Mutch's candidacy. The Ad Hoc Committee also considered potential options to obtain certain information necessary to assess the candidacies of the VIEX Nominees, including options available to the Company pursuant to the By-laws to request information from the VIEX

KVH Industries, Inc. 2021 Proxy Statement 13

BACKGROUND OF THE SOLICITATION

Nominees to address concerns identified by the Ad Hoc Committee in connection with its background research on the VIEX Nominees.

On March 3, 2021, the Nominating and Corporate Governance Committee met with the Independent Search Firm to discuss the status of the Company's ongoing Board refreshment process, including whether candidates with qualifications, backgrounds, and experiences that fit the profile developed by the Nominating and Corporate Governance Committee in light of the current composition of the Board had been identified. The Nominating and Corporate Governance Committee also discussed the meeting that Messrs. Dodez and Trimble held with Mr. Mutch, including the qualifications, skills, and experience of Mr. Mutch. At the conclusion of the meeting, the Nominating and Corporate Governance Committee directed the Independent Search Firm to conduct a further review of Mr. Mutch's candidacy to serve as a member of the Board.

On March 4, 2021, VIEX issued a press release announcing the Nomination Notice. The press release indicated, among other things, that VIEX owned 3.4% of the Company's outstanding shares of common stock, a decrease in VIEX's ownership position relative to what was disclosed to the Company in the Nomination Notice.

On March 5, 2021, the Company, pursuant to the By-laws, sent VIEX a letter (the "Supplemental Request Letter") requesting that the VIEX Nominees provide additional information regarding the eligibility of the VIEX Nominees to serve as members of the Board (the "Eligibility Information"). The Supplemental Request Letter sought additional context that the Board should consider when evaluating the Delaware Court of Chancery's opinion and findings in the PLX Case with respect to Mr. Singer's actions as a director at PLX, and certain other information intended to address questions and concerns identified by the Ad Hoc Committee through its background research on the VIEX Nominees, including information with respect to (i) any denials of D&O insurance coverage, or increased premiums in connection with such coverage, following any legal proceeding, including the PLX Case, (ii) any instances where another board of directors asked any of the VIEX Nominees to resign from the board or refused to re-nominate such individual, (iii) communications or understandings between the VIEX Nominees and Vintage Capital related to the Company or the Board, (iv) whether the VIEX Nominees had received consents from the other public company boards on which they served to serve as a director of the Company, and (v) how each VIEX Nominee intended to manage the responsibilities of serving on multiple public company boards, in addition to the responsibilities of their principal occupations, including in light of the fact that, at the time of the Supplemental Request Letter, Mr. Singer was seeking election at Velodyne Lidar, Inc., both VIEX Nominees were seeking election at Leaf Group Ltd., and both of the VIEX Nominees were already serving on two public company boards. The Supplemental Request Letter requested that the VIEX Nominees provide the Eligibility Information to the Company within five business days.

On March 8, 2021, the Ad Hoc Committee held a meeting to discuss the status of the Company's ongoing Board refreshment process, Mr. Mutch's background and research that had been conducted with respect to his service on public company boards, and the Supplemental Request Letter.

On March 12, 2021, a representative of Olshan Frome Wolosky LLP ("Olshan"), counsel to VIEX, sent representatives of Kirkland & Ellis LLP ("Kirkland"), counsel to the Company, a letter indicating that the VIEX Nominees would respond to any reasonable requests required to be disclosed under the By-laws no later than March 26, 2021 (the "March 12 VIEX Letter"). The March 12 VIEX Letter did not include any of the Eligibility Information.

On March 15, 2021, the Ad Hoc Committee held a meeting to discuss the March 12 VIEX Letter and the status of the Company's ongoing Board refreshment process. With respect to the March 12 VIEX Letter, the Ad Hoc Committee directed Kirkland to send Olshan a letter underscoring that failure to respond to the Supplemental Request Letter on a timely, complete, and accurate basis may constitute failure to comply with the advance notice requirements for director nominations as set forth in the By-laws (the "March 16 Company Letter").

Also on March 15, 2021, Mr. Bruun held a telephone call with Mr. Shaper to discuss the Company's business and operations.

On March 16, 2021, Kirkland sent Olshan the March 16 Company Letter.

On March 22, 2021, the Ad Hoc Committee held a meeting to discuss the status of the Company's ongoing Board refreshment process, the Company's potential slate of director nominees for election to the Board at the annual meeting, the proposed timing for announcing the Company's new director nominees and filing the Company's preliminary proxy statement with the SEC, and the fact that the Company had not yet received a response to the March 16 Company Letter.

14 KVH Industries, Inc. 2021 Proxy Statement

BACKGROUND OF THE SOLICITATION

On March 25, 2021, the Nominating and Corporate Governance Committee held a meeting to discuss the composition of the Board, the Company's potential nominees for election to the Board at the annual meeting, and the status of the Board's ongoing refreshment process, including the search being conducted by the Independent Search Firm.

On March 26, 2021, Mr. Singer sent a letter to the independent members of the Board (the "March 26 VIEX Letter"). Mr. Singer stated that VIEX believed that the Company's requests for the Eligibility Information in the Supplemental Request Letter were unreasonable. In addition, Mr. Singer stated that VIEX did not believe that the By-laws required the VIEX Nominees to respond to the questions set forth in the Supplemental Request Letter.

On April 5, 2021, the Ad Hoc Committee met to discuss the Company's potential slate of director nominees for election to the Board at the annual meeting and the March 26 VIEX Letter. The Ad Hoc Committee also discussed the possibility of reaching a settlement with VIEX.

On April 9, 2021, Mr. Shaper called Mr. Bruun to discuss the Company's business and operations, including Mr. Shaper's interest in facilitating the Company's entry into the energy sector. Neither during this conversation, nor in any prior conversation with representatives of the Company, did Mr. Shaper indicate that he intended to work with VIEX or be a participant in VIEX's solicitation of proxies for use at the annual meeting.

Also on April 9, 2021, VIEX filed the VIEX Preliminary Proxy Statement.

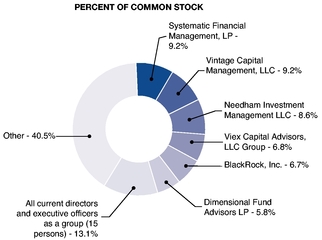

On April 12, 2021, VIEX filed a Schedule 13D with the SEC, reporting beneficial ownership of approximately 5.3% of the common stock (the "VIEX Schedule 13D").

Later on April 12, 2021, the Ad Hoc Committee held a meeting to discuss the VIEX Preliminary Proxy Statement, the VIEX Schedule 13D, and the status of the Company's ongoing Board refreshment process, including the background and experiences of certain potential nominees for election to the Board at the annual meeting. In addition, the Ad Hoc Committee discussed the terms on which the Company might be willing to settle with VIEX.

On April 19, 2021, VIEX filed an amendment to the VIEX Schedule 13D, disclosing that Bradley L. Radoff and Mr. Shaper had joined VIEX's "group," within the meaning of Section 13(d)(3) of the Exchange Act, for the purpose of seeking the election of the VIEX Nominees to the Board at the annual meeting.

Also on April 19, 2021, the Ad Hoc Committee met to discuss the amendment to the VIEX Schedule 13D filed earlier the same day. The Ad Hoc Committee also discussed the backgrounds and experiences of certain potential nominees for election to the Board at the annual meeting.

On April 29, 2021, the Nominating and Corporate Governance Committee concluded its nearly three-month search process during which it worked with the Independent Search Firm to identify, evaluate and interview director candidates that met criteria developed by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee determined that it would recommend Ms. Dolecki and Ms. Hernandez for nomination to the Board. Ms. Dolecki and Ms. Hernandez were both identified by the Independent Search Firm.

On the same day, the Board held a meeting to discuss the candidacies of Ms. Dolecki and Ms. Hernandez, the annual meeting, and matters related to VIEX. At the meeting, the Board determined that it was in the best interests of the Company and its stockholders for Ms. Dolecki and Ms. Hernandez to serve as the Company's nominees for election to the Board at the annual meeting. In addition, the Board directed representatives of Kirkland to reengage with Olshan regarding the Supplemental Request Letter and to discuss a possible settlement between the Company and VIEX. The Board also concluded that, because the VIEX Nominees failed to provide the Eligiblity Information as required by the By-laws, the VIEX Nominees would not be eligible to stand for election at the annual meeting and, pursuant to the By-laws, the person presiding at the annual meeting should disregard any attempted nomination of the VIEX Nominees.

On April 30, 2021, Mr. Shaper contacted Mr. Kits van Heyningen requesting a meeting. Later that day Mr. Kits van Heyningen held a telephone call with Mr. Shaper to discuss his involvement with the VIEX "group" and his interest in working with the Company. Among other things, Mr. Shaper indicated that he had only spoken with Mr. Singer once and that he had never spoken with Mr. Mutch.